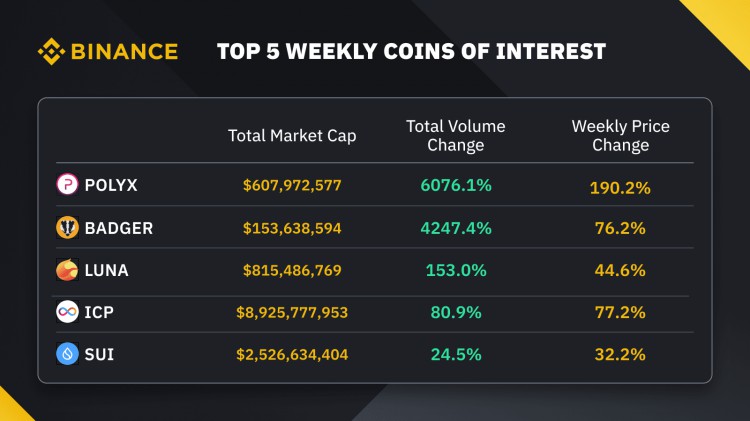

Polymesh ($POLYX) 是一種專為受監管資產設計的機構級許可區塊鏈,在貝萊德探索真實世界資產 (RWA) 代幣化領域後,它獲得了市場關注。 它的突出反映了人們對基於區塊鏈的金融解決方案日益增長的興趣,使其成為這個不斷發展的領域的市場領導者。 7天內190%的漲幅顯示了對該代幣的高需求以及市場對該項目的興趣。

Badger ($BADGER) 是一個 DAO,旨在將比特幣作為 DeFi 應用的抵押資產。 Badger DAO 推出了一種合成 BTC 代幣(eBTC),這項功能在 DeFi 借貸中具有巨大的應用潛力。 該穩定幣參考比特幣匯率並在以太坊網路上運行,使用 Lido 質押的以太幣(stETH)作為債券。 這一目標可以透過實施旨在提高整個 DeFi 領域的去中心化和資本效率的策略來實現。

Do Kwon 從黑山監獄正式釋放後,Terra ($LUNA) 在過去 7 天內上漲了 44.6%。 強勁的漲勢也增加了社群媒體平台上的熱門首發,推動價格走高。

整體市場

上圖顯示了過去 30 天的 BTC 價格走勢。

如前所述,我們預計上週 BTC 將從歷史高點下跌,並在 6 萬美元水平找到支撐,如上方紅色方框所示。 對 6 萬美元水平附近比特幣的強勁需求,加上聯準會主席鮑威爾的鴿派言論,將比特幣價格推回 6.8 萬美元阻力區。

聯準會主席鮑威爾在聯準會將利率維持在5.50%後發表了一些鴿派言論,最新的點陣圖顯示2024年將進行三次降息。他還提到聯準會計畫很快就縮減量化緊縮(QT)計畫。 鮑威爾的言論以及點陣圖預期的降息路徑提振了市場情緒,並推高了風險資產。 比特幣多頭利用了這種情緒,迫使空頭平倉。 鮑威爾新聞發布會的結果是,比特幣價格在四個小時內回到了 6.8 萬美元。

然而,我們的團隊注意到過去兩天比特幣價格出現短期下跌趨勢。 69,000 美元的關鍵水平現在作為支撐。 如果比特幣價格跌破 6.9 萬美元,則將測試上行通道的下限。

選擇權市場

上表顯示了 BTC 和 ETH 選擇權的 25 delta 偏度。

由於FOMC會議後市場情緒有所改善,比特幣和以太坊的價格從上週的低點上漲,目前橫盤整理。

The 25-delta skews on BTC options return to positive territory for all tenors. It demonstrates that market sentiment on BTC leans towards a bullish view. The skewness in front-end options is close to zero, indicating that market sentiment is more or less balanced and that there is no clear direction for BTC price in the short term, according to data.

On the other hand, the 25-delta skews in ETH options do not indicate such a bullish sentiment. In the short to medium term, the skews on ETH options remain negative. Although the skews in the short-term options are less negative than last week's data, it indicates that investors and traders are less willing to hold positive delta positions on Ethereum, and the market is betting on Bitcoin's short to medium-term performance rather than Ethereum's.

Macro at a glance

Last Wednesday (24-03-20)

The Federal Reserve announced that its interest rate would remain at 5.50%, unchanged. Fed Chairman Powell's dovish comments boosted gold, equities, and cryptocurrency markets following the press conference. The dot plot indicates that the Federal Reserve will make three quarter-percentage point cuts in 2024. The market expects the Fed's first rate cut in June.

Last Thursday (24-03-21)

The Bank of England maintained its interest rate at 5.25%, unchanged. The Bank's governor, Andrew Bailey, stated that the rate cut decision would be data-driven, and the data indicated that it was in the right direction.

Last week, initial jobless claims in the United States totalled 210k, which was in line with the forecast of 212k. As Powell stated in the press following the FOMC meeting on Wednesday, the strong labour market would not cause the Fed to be concerned about rising inflation.

On Tuesday (24-03-26)

In February, US durable goods orders rose by 1.4% month on month, exceeding the expected 1.2% increase. Durable goods orders have begun to recover from January's 6.9% drop.

In March, US Conference Board (CB) consumer confidence was 104.7, lower than expected at 106.9. The lower-than-expected consumer confidence data suggested that consumer demand had eased, which would help to reduce inflation over time.

This Friday, the PCE price index data will be released, which could provide more clarity to the market if the US inflation rate moves in the direction expected by the Federal Reserve. It will also provide insight into the Fed's rate cuts this year.

Convert Portal Volume Change

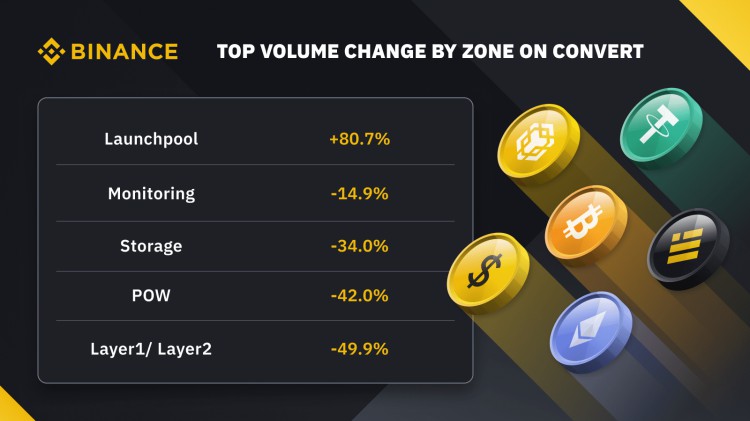

The above table shows the volume change on our Convert Portal by zone.

This week, our desk noticed that trading volume increased significantly in the Launchpool while remaining low in other zones.

Over the last seven days, the Launchpool Zone has seen the greatest percentage increase in volume. Trading volume increased by 80.7%, primarily due to increased trade demand for Shentu ($CTK).

Convert 監控區域的交易量下降了 14.9%。 在監控區域的所有代幣中,Enzyme ($MLN) 的交易需求增長最多,而 JasmyCoin ($JASMY) 的交易需求下降最多。

隨著市場橫盤整理,Layer1/Layer2 區域的成交量也下降了 49.9%。 大市值的 Layer1 和 Layer2 代幣在本次交易量下降中佔權重。

為什麼進行場外交易?

幣安提供客戶多種方式進行場外交易,包括聊天溝通管道和幣安場外交易平台(https://www.binance.com/en/otc),手動報價、演算法訂單或透過Binance Convert 自動報價大宗交易平台 (https://www.binance.com/en/convert) 和 Binance Convert OTC API。

電子郵件: trading@binance.com 以了解更多資訊。

加入我們的 Telegram ( https://t.me/BinanceOTC ) 以了解最新市場動態