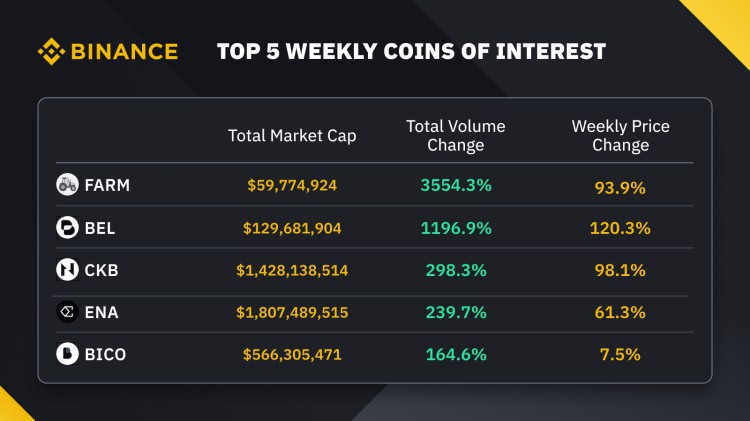

上週,Harvest Finance 流動性挖礦協議的原生代幣 $FARM 由於交易量大幅增加,價格上漲了 93.9%。 Harvest Finance 是一種流動性挖礦協議,可在多個 DeFi 平台上分配用戶資金以產生回報。

Bella Protocol ($BEL) 最近與 Manta Network ($MANTA) 建立了戰略合作夥伴關係。 Bella Protocol 致力於在流動性挖礦領域探索新的合作夥伴關係,以增加其社區的收益機會,推動基礎設施層和DeFi 應用的發展,並為跨不同領域的更廣泛、高效和公平的DeFi 生態系統鋪平道路。

Nervos($CKB)上週上漲 98.1%。這種激增與RGB++的應用密切相關,RGB++是基於RGB(Really Good Bitcoin)成功的擴充協定。 RGB++ 透過利用比特幣的閃電網路側鍊和第 2 層功能來解決可擴充性問題。

Ethena ($ENA) 是一種基於以太坊的合成美元協議,它將提供不依賴傳統銀行基礎設施的加密貨幣原生解決方案。其近期宣布增加股權獎勵引發市場需求,股價7天內上漲61.3%。

整體市場

上圖顯示了上個月 BTC 價格走勢。

BTC 從下方紅線找到趨勢線支撐,並在週一突破了上方阻力趨勢線。然而,BTC 價格未能站上楔形上限,目前交易價格約為 6.9 萬美元。

週二,假突破擺脫了一些槓桿多頭頭寸,在過去 24 小時內清算了該交易所超過 1500 萬美元的多頭頭寸。

由於距離 BTC 減半日還有不到兩週的時間,我們預計未來幾週市場將會更加波動。

如果未能守住 69,000 美元的支撐位,則下一個支撐位位於較低趨勢線附近的 66,500 美元左右,然後是紅色標記的 60,000 美元強勁需求區域。

上圖顯示了上個月 ETH 價格走勢。

另一方面,ETH成功突破下降趨勢線並將其轉為支撐。

繼 Vitalik 最後一刻出現在香港最大的 Web3 活動之後,ETH 在亞洲時段經歷了強勁的需求,並在歐洲時段延續了其勢頭。在美國時段回檔之前,ETH 價格在 12 小時內上漲了 8% 以上。

看跌情緒源自於 5 月 SEC ETF 批准前景減弱,而 BTC 價差的拋售加劇了下行壓力。

如果 ETH 能夠保持在目前作為支撐的下行趨勢線之上,那麼下一個主要供應區域將在 4,100 美元左右。

選擇權市場

上表顯示了 BTC 和 ETH 選擇權的 25 delta 偏度。

The BTC reward halving date is approaching, with an estimated date of April 19, 2024. Following Monday's fake breakout, the 25-delta skew is slightly below zero on the front end. We observed a similar skew on ETH options with the same duration.

In the intermedia tenor, the skew of BTC options remains above zero for both 30-day and 60-day expiry. With the same expiries, the skews of ETH options are closer to the 0 level.

Options traders are more risk averse on BTC near-term options, despite maintaining a positive outlook after the halving. They are less bullish on ETH in the medium term, especially since investors and traders have given up hope of an SEC ETF approval in May.

With the halving event only two weeks away, our desk expects implied volatility to rise and short-term options to have higher premiums. It is critical to manage risks around this long-awaited event.

Macro at a glance

Last Thursday (24-04-04)

US initial jobless claims rose to 221k last week, exceeding the estimated 213k and the previous week's 212k. The initial jobless claims are a proxy measure of the US labor market, and they have been reported in the 210k range over the last nine weeks.

Several FOMC members made hawkish remarks about the fewer rate cuts in 2024. Risk assets fell sharply, while the US dollar and US Treasury yields rose.

Last Friday (24-04-05)

US nonfarm payrolls increased by 303k in March, far exceeding the expected 212k and last month's 270k. The strong nonfarm payrolls indicate that the US labour market is stronger than expected.

The US unemployment rate fell back to 3.8% in March, having risen from 3.7% in January to 3.9% in February. The data provided clear support for the hawkish remarks made by several FOMC members yesterday.

The Canadian unemployment rate increased from 5.8% in February to 6.1% in March, exceeding the expected 5.9%.

This Monday (24-04-08)

Israel announced on Sunday that it had withdrawn additional soldiers from southern Gaza. The easing of geopolitical tensions caused a retracement in gold and oil prices. Risk assets rose in the US session.

BTC unexpectedly soared above $71k with increased implied volatility in options. ETH outperformed BTC following Vitalik's last-minute appearance at Hong Kong's largest Web3 event to give a technical talk on blockchain technology.

Later this week, we have

US CPI data on Wednesday

Bank of Canada interest rate decision on Wednesday

FOMC meeting minutes on Wednesday

European Central Bank interest rate decision on Thursday

Convert Portal Volume Change

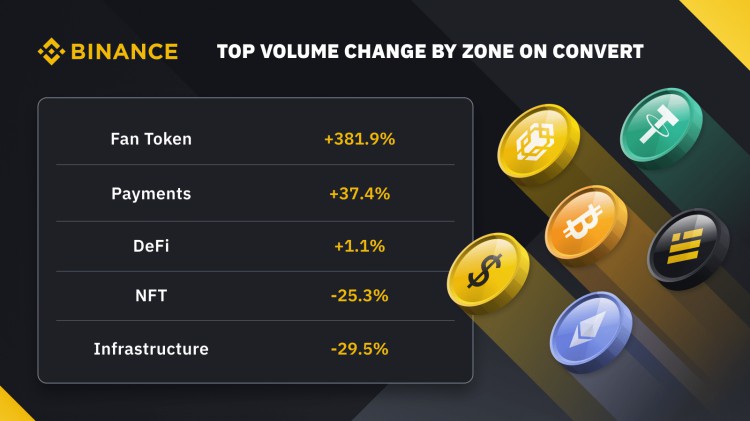

The above table shows the volume change on our Convert Portal by zone.

This week, our desk noticed that trading volume increased significantly in Fan Token and Payments zones.

Over the last seven days, the Fan Token Zone has experienced the greatest percentage increase in volume. AS Roma Fan Token ($ASR) is the main contributor to such tremendous growth.

Convert 支付區的交易量增加了 37.4%。在支付區的所有代幣中,Pundi X ($PUNDIX) 的交易需求增幅最高。

DeFi 區域的交易量也成長了 1.1%。 Harvest Finance ($FARM) 和 Bella Protocol ($BEL) 在該區域的交易量成長最為顯著,對成長的貢獻最大。

為什麼進行場外交易?

幣安提供客戶多種方式進行場外交易,包括聊天溝通管道和幣安場外交易平台(https://www.binance.com/en/otc),手動報價、演算法訂單或透過Binance Convert 自動報價大宗交易平台 (https://www.binance.com/en/convert) 和 Binance Convert OTC API。

電子郵件: trading@binance.com 了解更多。

加入我們的 Telegram ( https://t.me/BinanceOTC ) 以了解最新市場動態!