上週三突破 51,000 美元後,比特幣在 53,000 美元處遭遇強勁阻力,目前在 51,000 美元至 53,000 美元區間橫盤交易。

雖然比特幣正在努力爭取另一條腿,但山寨幣領域卻充滿了表現強勁的貨幣。

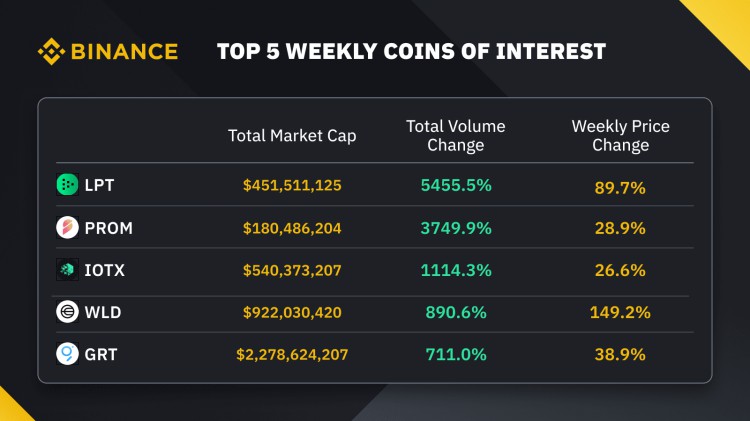

OpenAI 最近發布的文本轉視訊模型 Sora 重新點燃了市場對人工智慧 (AI) 的興趣。 Worldcoin ($WLD) 由 Sam Altman、Max Novendstern 和 Alex Blania 於 2019 年創立,是該產品發布後的獲獎者之一。 Sam Altman 也是 OpenAI 的執行長。 Sora 推出後僅四天內,WLD 價格就從 3.50 美元上漲至 7.80 美元。

Livepeer ($LPT) 也受惠於 Sora 的介紹。 Livepeer 是一種去中心化的即時視訊串流網路協議,它利用去中心化技術為傳統的集中式廣播方法提供可行的替代方案。 消息傳出後的兩天內,LPT 的市值幾乎增加了兩倍,目前交易價格為 15 美元。

Prom ($PROM) 也經歷了動蕩的一周,在 DWF Labs 首席執行官 Andrei Grachev 公開證實他對該項目的個人投資後幾個小時內漲幅超過 90%。 Prom 是一個遊戲非同質代幣 (NFT) 市場和租賃平台,允許 NFT 的無抵押租賃和抵押服務。

整體市場

上圖顯示了自 2021 年 12 月以來 BTC 價格走勢。

正如我們上週討論的那樣,BTC 在 53,000 美元上方面臨重大阻力,如紅色區域所示。 如果BTC克服這一阻力位,則在達到59,000美元之前不會有重大阻力。 因此,空頭將盡力捍衛此阻力位。

儘管比特幣在過去幾天一直橫盤整理,但來自比特幣現貨 ETF 的資金流入仍然強勁。 比特幣 ETF 每天持續 300 至 5 億美元的淨流入表明投資者對比特幣風險敞口的高需求。

然而,比特幣價格上個月上漲了 35%,從 FTX 破產財產清算 10 億美元 GBTC 以來的最低水準 38,500 美元上漲至 52,000 美元。 投資者和交易員將資金從比特幣轉向其他山寨幣並不奇怪。 考慮到比特幣價格的大幅波動,這種資本輪換是完全正常的。

上圖顯示了過去兩週 ETH/BTC 的價格走勢。

上週三,比特幣飆升並突破 51,000 美元後,我們的團隊注意到對以太坊的強勁需求。 在過去的7天內,ETH/BTC價格從0.0531上漲至0.0572,ETH表現優於BTC。

我們的團隊預計 ETH/BTC 的這種上漲趨勢將在未來幾週內持續,因為 ETH 網路將在 3 月進行期待已久的 Dencun 升級。

Another factor contributing to the ETH price's outperformance is the potential approval of an Ethereum spot ETF. Currently, the market expects the SEC approval in May.

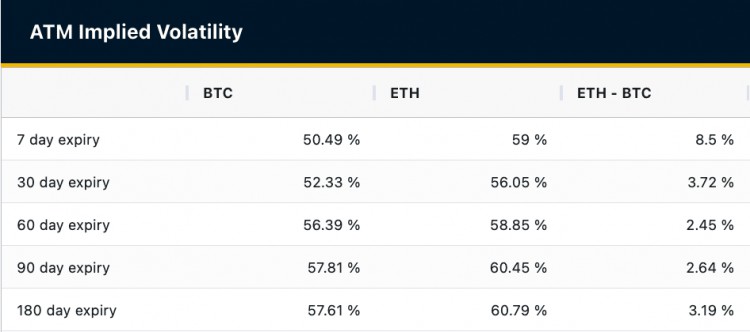

The above table shows the at-the-money implied volatility for BTC and ETH options with different expiries.

While the implied volatilities for BTC options are all above 50%, they stay at the same level as last week. On the other hand, the implied volatilities for ETH options are around 60%, except for the 30-day expiry one.

With a large difference in IVs between ETH options and BTC options in the front end, it seems options traders are buying ETH options and pushing the options in the front-end tenor to be higher. It signals that a potential large movement in ETH price in the next few days is priced in the options market.

It will be interesting to monitor the IV on ETH near-term options and see if it retraces to the normal range soon. As the bulls failed to hold their ground and keep the ETH price above the $3,000 critical level, our desk expects to see both bulls and bears push forward and crash on the other side.

Given the high IVs on ETH front-end options, selling covered calls and covered puts can yield nice returns. For example, selling an ETH-3000 call expiring March 1 will collect an 86.4 USDT premium, a 119% annualized yield, with a spot reference of 2940 USDT.

Last Thursday (2024-02-15)

In January, US retail sales fell 0.8% month on month, more than the expected 0.2% drop. The retail sales growth rate in December was revised to 0.4% from 0.6%. Core retail sales fell 0.6% on a monthly basis in January, compared to the expected 0.2% increase.

US initial jobless claims remained in the low range, with 212k new claims reported last week, slightly exceeding the expected 219k.

British retail sales increased by the most in nearly three years in January as consumers regained their appetite for spending, implying that the economy could recover more quickly than expected from its recession in the second half of last year. Retail sales increased by 3.4% in January, far exceeding the estimated 1.5% increase and December's 3.3% decrease.

Last Friday (2024-02-16)

The US PPI increased by 0.3% on a monthly basis in January, surpassing both the previous month's -0.1% and the estimated 0.1% increase. The rising PPI will put upward pressure on inflation and could lead to a later rate cut by the Fed.

According to Statistics Canada, Canada's CPI fell to 2.9% year on year in January, down from 3.4% the previous month. This reading came in lower than the market's expectation of 3.3%. On a monthly basis, the CPI remained unchanged, despite the expected 0.4% increase. The annual Core CPI increased by 2.4% during the same period, down from 2.6% in December. The disinflationary numbers in Canada raise the possibility of an early rate cut by the Bank of Canada.

On Tuesday (2024-02-20)

China's central bank cut the 5-year loan prime rate by 0.25 basis points to 3.95%, while leaving the 1-year rate unchanged at 3.45%. This rate cut is regarded as the latest effort to relieve pressure on the country's struggling real estate market.

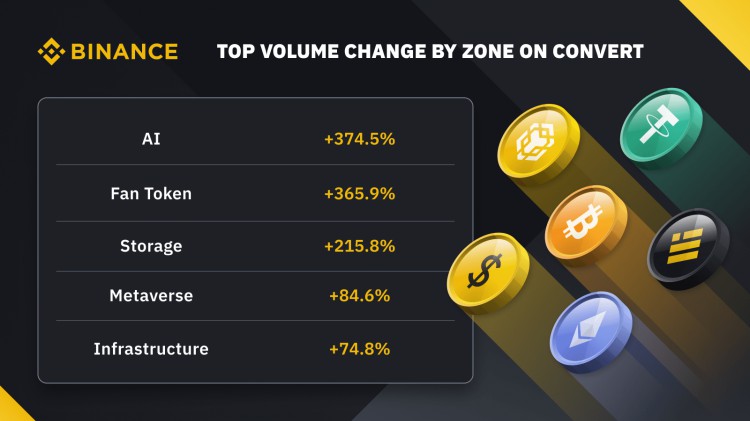

The above table shows the volume change on our Convert Portal by zone.

This week our desk observed massive trading demand on AI and Fan Token zones.

The impressive 374.5% volume increase in the AI zone is mainly due to the strong demand for Worldcoin ($WLD). The newly released OpenAI product Sora renewed the market's enthusiasm for Worldcoin, an iris biometric cryptocurrency project founded by Sam Altman, OpenAI's CEO.

The trading volume in the Storage zone also doubled. The main drivers of increased demand are Arweave ($AR) and Filecoin ($FIL). Filecoin ($FIL), a peer-to-peer file storage network, announced on Sunday that it will collaborate with smart contract platform Solana (SOL) to develop decentralized blockchain storage solutions. The announcement caused Filecoin to rise from $5.8 to $7.4 in three days.

Binance offers our clients various ways to access OTC trading, including chat communication channels and the Binance OTC platform (https://www.binance.com/en/otc) for manual price quotations, Algo Orders, or automated price quotations via Binance Convert and Block Trade platform (https://www.binance.com/en/convert) and the Binance Convert OTC API.

To access manual price quotations, you may visit our Binance OTC platform (https://www.binance.com/en/OTC-Trading/spot), where you can RFQ (request-for-quote) and trade directly with our OTC trading team via a live chat.

To utilise our Algo orders features, you may visit our BinanceAlgo Orders platform (https://www.binance.com/en/OTC-Trading/AlgoTrading).

For any other inquiries on OTC trading, please reach out to us via our email at trading@binance.com for our trading desk to get in touch with you and get started.

OTC trades may also be automatically quoted on Binance Convert and via API, offering users a quick and simple way to execute trades across 60,000+ pairs with one simple click. Binance Convert supports over 350 tokens listed on the exchange including fiat pairs. Begin trading from as little as 1 USD. To start, simply navigate to the Binance Convert & Block Trade platform (https://www.binance.com/en/convert), select the coins you wish to trade, preview and confirm the quote with settlement reflecting almost instantly in your wallet balance. For details and access to Binance Convert OTC API, please refer to our Convert Endpoints (https://binance-docs.github.io/apidocs/spot/en/#convert-endpoints) and reach out to us at trading@binance.com if you have any questions or require assistance.

Visit Binance OTC (https://www.binance.com/en/otc) for more information on our OTC products and solutions.

體驗 Binance Convert 和 OTC 交易的主要優勢:

快速且有競爭力的定價

即時結算

最廣泛的硬幣可用性

具有獨特市場洞察的客製化服務

零費用和零滑點

電子郵件: trading@binance.com

加入我們的 Telegram ( https://t.me/BinanceOTC ) 以了解最新市場動態!